Unlocking the Power of Loyalty Sites in Canada: Insights on Financial Habits in 2023

Discover insights from our 2023 Canada Finance guide, revealing how loyalty sites impact financial habits, credit card usage, and more.

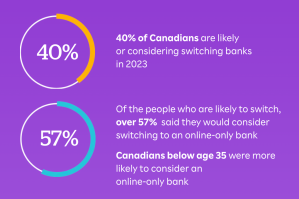

In early 2023, we surveyed Canadian consumers regarding their financial habits, including their opinions and plans around opening new credit cards and bank accounts, what they look for when considering new options, and their thoughts around neo banking or going branchless. We uncovered more than we anticipated, with the Canadian finance customer proving that they actively seek out reward and loyalty sites when making their purchases.

This consumer is a savvy shopper who maximizes their savings, sometimes through their credit card points, but frequently through loyalty and reward sites such as Great Canadian Rebates, Rakuten.ca, creditcardGenius, and others. These sites provide a variety of perks to the consumer for doing their everyday purchases, whether it be getting cashback, rebates, or credit card points.

Loyalty sites & credit cards: a partnership for the ages

Our survey results showed of the 87% of Canadians on the hunt for new financial services in 2023, 50% of them were looking for a new credit card or bank account.

This group of new financial service researchers overwhelmingly made note that they are also members of an online loyalty or reward site and search for coupons when making a purchase.

In fact:

- Over 92% of consumers use or search for coupons before making a purchase.

- 79% are members of loyalty or reward

Belonging to a loyalty or reward site isn’t exclusive to consumers searching for new financial services, our survey shows that 81% of all Canadian consumers are members of these sites.

As a financial brand looking to grow a customer base in Canada, partners that already offer cash back or points will give you a competitive edge and a sustainable partnership through the ages. These sites already have your target audience (around 80% of them!), and if you’re promoting your services including your credit card offerings, banking services, loan opportunities, etc., the likelihood they’ll become your customers is significantly higher than if you weren’t on those sites.

For additional insights on the Canadian finance consumer, access our latest report: Navigating 2023’s Shifting Landscape of Financial Needs in Canada.