Affiliate Trend Watch Panel 2023

Get exclusive insights into the latest Affiliate Trends from our panel session at DealMaker USA. Discover industry-first data, cutting-edge insights, and strategies to stay ahead of the game in affiliate marketing.

At this year’s DealMaker USA, we hosted several exciting panel discussions on the main stage, but one that was standing room only was Affiliate Trend Watch, hosted by Alex Czurylo, SVP, Group Product Operations, Rakuten Advertising. This panel featured Dave Gill, VP of Consumer Insights at Rakuten Advertising, Lauryn Vaughn, CEO of ReUpp, and Katelan Blake, E-commerce Manager at Dyson.

The Affiliate Trend Watch panel revealed industry-first data and relevant insights on consumer behavior trends in the current US market. Attendees discovered how these trends can grow business and learned strategies to stay ahead of the game. From affiliate marketing to market trends, this panel focused on the knowledge and tools needed to win.

Overall E-Commerce Trends in the US

Following the past two booming years of e-commerce sales, 2023 is experiencing a slowdown due to climbing interest rates. This slowdown began in May 2022 due to many macro-economic factors but a major contributor to this slowdown in e-commerce sales came from the grocery sector. Grocery is not only the largest category of household spending, with about 1.3T contributing to sales in 2020, but as the pandemic wanes, people are returning to in-person shopping, effectively cutting e-commerce sales.

Key household spending categories in home and appliance are also seeing a slowdown post-stay-home pandemic. Consumers took the at-home time to replace old appliances and update their homes. This consumer is now back to work and accomplished any updating during the pandemic, which is now contributing to softness YoY.

Despite the slowdown, the following categories saw e-commerce growth YoY:

- Electronics & Accessories: +22% Q1 2023 v. Q1 2022

- Health & Beauty: +3.2% Q1 2023 v. Q1 2022

The Travel Industry

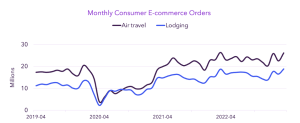

The travel industry is a true standout in the ecommerce space with travel recovery back in full swing. Booked air travel and lodging are at-or-around the same level as pre-pandemic.

The correlation between air travel and lodging proves that consumers are planning to travel and want to return to their regular plans.

Consumers have a strong desire to travel, and the data proves just that:

- Click activity is on the rise but isn’t yet back to pre-pandemic levels – likely due to the global economy and other macroeconomic factors.

- Conversion is significantly up compared to pre-pandemic levels and continues to rise as those who can afford to spend or prioritize spending on travel, are finding deals and converting.

- Compared to other key e-commerce verticals, travel buyers spend +10% more dollars than buyers in apparel, auto, electronics, grocery, home and kitchen, jewelry and watches, and online services.

Alternative Payment Trends

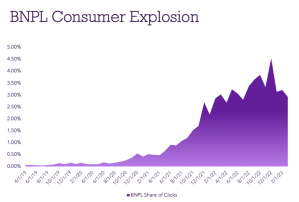

Finance is top of mind for many affiliate managers and the addition of BNPL (Buy-Now-Pay-Later) services in recent years is no different. BNPL services are now the norm, with this purchasing method accounting for nearly 5% of all orders during the 2022 holiday season and driving 100M users worldwide.

With this payment explosion, here are the key trends Alex Czurylo and fellow panelists are watching:

- Users are turning to BNPL more often as they struggle to make ends meet. This may come in part from everyday expenses where use has been growing, per the Consumer Financial Protection Bureau (CFPB).

- Raising merchant acceptance gives users more opportunities to spend. BNPL is moving into new sectors, with grocery, healthcare, legal services, and travel ripe for gains. Major retail partners like Amazon are also embracing the tech. In-store penetration is on the rise thanks to physical and virtual card growth.

- New entrants could improve accessibility. Apple and Walmart will reportedly enter the space this year.

Another trend to keep an eye on will be Super Apps, which are digital ecosystems of products and services housed under a single application and unified user experience.

- Core offerings include payments, messaging, e-commerce, and ridesharing.

- Super apps can also help providers personalize the user experience because they harness a much wider array of customer and transactional data.

Reaching Gen Z

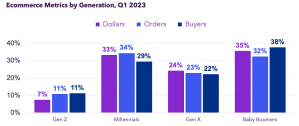

While Gen Z may talk a big game, they aren’t quite meeting the precedents set by older generations, with the 18-24 age group being a significantly smaller segment of the market. While they are spending less, they shouldn’t be counted out – they still make up 7% of the market.

This group is spending its money on a rapidly growing market – the secondhand resale market. More than half of Gen Z are more likely to shop with a brand that offers secondhand alongside new, up from 2021, with more than 60% looking for secondhand apparel before even beginning their search for new items.

Still, if you’re looking to capture the younger market, target the millennial audience – they are the biggest spenders across all age ranges, with the 80s and 90s-born group spending the most e-commerce dollars per buyer by generation.

For additional trends and insights, check out our resource center that features case studies from leading retailers, finance and travel affiliate reports, and more! To learn more about other panels and sessions at DealMaker USA 2023, read it here.