A Look Back on the 2022 Back to School Shopping Season

As summer comes to an end and students return to their classrooms, we look back on our network performance for the back-to-school period.

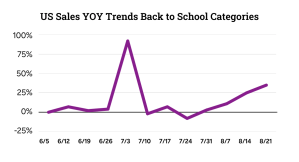

Despite concerns of inflation on back-to-school items, we still saw increased sales YoY. This is promising news as we head into the peak retail season for Holiday 2022.

Sales, Conversion Rates, and Order Numbers

Within our US network, the same-store average spending total showed a growth of 9% YoY. More specifically, for back-to-school items such as apparel, beauty, books, department stores, education, footwear, and computers, we saw summer spending grow 14% YoY. However, conversion rates and orders didn’t follow the same pattern, which suggests that shoppers are cutting back on the number of online transactions and taking the time to research before purchasing. Overall, retail stores had orders drop 5% versus 2021 and conversion rates also dropped from 4.0% to 3.8% YoY.

Within our US network, the same-store average spending total showed a growth of 9% YoY. More specifically, for back-to-school items such as apparel, beauty, books, department stores, education, footwear, and computers, we saw summer spending grow 14% YoY. However, conversion rates and orders didn’t follow the same pattern, which suggests that shoppers are cutting back on the number of online transactions and taking the time to research before purchasing. Overall, retail stores had orders drop 5% versus 2021 and conversion rates also dropped from 4.0% to 3.8% YoY.

The Effects of Inflation

While it’s undoubtedly true that inflation has had an impact on back-to-school shopping, it has not affected it nearly as much as experts had feared. Back-to-school shopping is a necessity for families with school-aged children, so there hasn’t been as large of a dip in orders from inflation as in other retail sectors.

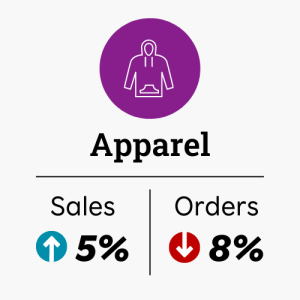

Apparel and department stores are top summer and back-to-school destinations, and both saw an increase in spending between 5% and 18% YoY. Despite the hike in sale totals, orders were down 8-10% YoY. Footwear and sporting goods retailers also saw spending increase, but interestingly also saw orders increase YoY.

Falling conversion rates are a major indication that inflation is impacting online spending. Shoppers are willing to spend but are also taking their time before making a purchase. They are returning to the same store website week-over-week to hunt for the best deals or checking out competitors to see who is less expensive before deciding to buy.

Top Publisher Verticals

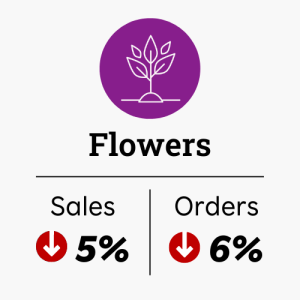

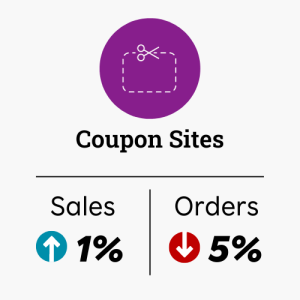

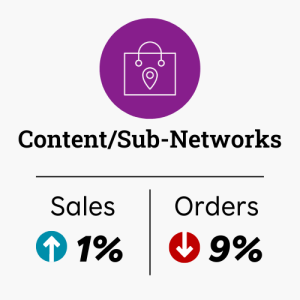

For our top publisher verticals for back-to-school, shopping habits over the summer saw moderate increases in sales and simultaneous dropping order volumes.

When looking at top publisher verticals that skew toward high-fashion and luxury shoppers, this trend is drastically different. Luxury and high-end fashion brands saw a 25% increase in sales YoY and an increase of 18% for orders. This shows that the high-end consumer is willing to spend, regardless of the discount or sale. Conversion rates still remained flat at 2.7% YoY. General shopping retailers were up 11% in spending YoY and slightly down by 1% YoY.

For more insights on the 2022 Back-to-School season, access our 2022 Back-to-School Report.