2020 Cyber Week (and more) Recap

Cyber Week continues to be the biggest shopping week on the calendar for shoppers and brands alike. Rakuten Advertising data shows that shoppers placed significantly more orders during Cyber Week than any other week in 2020, despite the fact that brands have been making an effort to spread deals throughout the holiday season.

Cyber Week continues to be the biggest shopping week on the calendar for shoppers and brands alike. Rakuten Advertising data shows that shoppers placed significantly more orders during Cyber Week than any other week in 2020, despite the fact that brands have been making an effort to spread deals throughout the holiday season.

The National Retail Federation (NRF) reports that while the number of people who shopped overall during Cyber Week was down slightly compared to last year, the number of online-only shoppers grew by 44% year-over-year.

Here’s a look at the trends we’ve seen across our network throughout Cyber Week and the early part of the holiday shopping season.

US Affiliate Trends

Electronics, Content Publishers Lead the Way in Order Growth

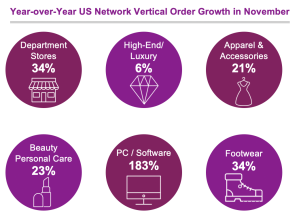

Electronics have historically been among the most popular products during November, and that trend continued throughout the early part of the 2020 holiday shopping season.

Orders of personal computers, software, and other high-end electronic accessories were up 183% year-over-year on the Rakuten Advertising network throughout November. Electronics have historically been a hot product around the holidays. Sales of computers and other electronic accessories were likely buoyed by the fact that people are spending more time indoors due to the pandemic and are looking for the latest technology for their homes.

Department stores also enjoyed a 34% year-over-year boost in orders in the month of November. This helped offset declines in store foot traffic throughout the month and particularly on Black Friday as a result of precautions being taken in response to the pandemic. Many department stores have had to shift their focus not just towards shipping online orders directly to consumers’ homes, but also towards curbside and in-store pickup to better leverage their storefronts to fulfill online orders.

That shift in focus likely helped attract more online shoppers who might have gone elsewhere by offering those shoppers the opportunity to get their online orders same day while offset some potential losses from a drop in store traffic.

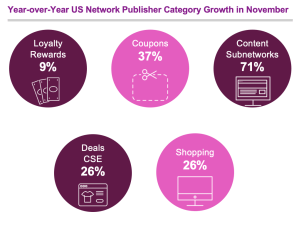

Meanwhile, shoppers who are spending more time at home found themselves visiting more content publishers. Traffic to content and/or subnetworks, including blogs and social media influencers, was up 73% year-over-year during November 2020. This suggests that consumers were looking for more than just a great deal, rather they were looking to content publishers to tell them more about products they were interested in buying.

Spreading Out the Deals Pays Off

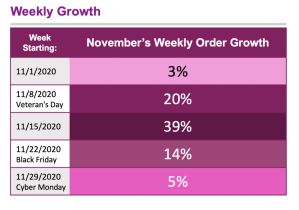

The 2020 holiday shopping season saw brands place greater emphasis on spreading out deals.

Overall online order growth across the Rakuten Advertising network shows that shoppers responded. The month of November produced a steady growth pattern on a week-by-week basis, with the week prior to Black Friday actually producing the highest year-over-year order gains.

Cyber Week: Shoppers Continue to Spend More Online on Cyber Monday

Just as the weeks leading up to Cyber Week produced the biggest year-over-year growth, so too did the days leading up to Cyber Weekend, the stretch from Thanksgiving-Cyber Monday that is traditionally the biggest weekend of the retail year.

The Tuesday before Thanksgiving on the Rakuten Advertising network saw:

- 84% year-over-year order growth

- 83% year-over-year click growth

- 58% year-over-year gross sales growth

But when it comes to total sales and conversions, Cyber Weekend continues to reign supreme.

That is, in part, because old habits die hard with online shoppers. Shoppers have been conditioned to mark their calendars for the Friday-Monday after Thanksgiving to expect the deepest discounts and the best values. That’s why Cyber Monday ranked number one for average order value while Black Friday generated the most clicks, orders and sales.

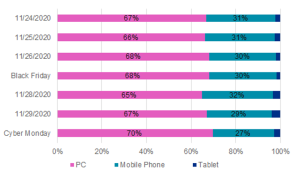

Desktop Gains on Mobile

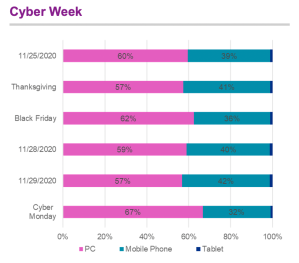

For years, we’ve been hearing about how mobile commerce is gaining ground on desktop.

During Cyber Week 2020, however, we saw the needle move in the other direction. Desktop either held its ground or posted slight percentage gains when it came to total order share throughout Cyber Week compared to last year.

For instance, desktop accounted for 67% of all orders on Cyber Monday 2020, up from 64% on Cyber Monday 2019.

This likely owes to a couple of factors:

- People are spending more time at home: With most offices across North America closed due to precautions put into place as a result of the pandemic, shoppers are spending more time at home and less time commuting. This, in turn, means more time spent browsing on desktop computers, which naturally lends itself to more purchasing opportunities on those devices.

- Shoppers aren’t spending as much time in stores: Mobile phone browsing and buying has historically been aided by shoppers looking for products on their phones while in stores. In 2020, people have mostly shopped in stores only for the essentials, which means they know exactly what they are looking for when they get to the store. This has, in turn, created fewer impulse in-store smartphone purchasing opportunities.

How Individual Verticals and Products Fared

Here’s a look at how individual verticals fared on our network during Cyber Week 2020.

- Department stores: Shoppers took advantage of the early shopping and made the Tuesday before Thanksgiving the fastest growing day for department store orders. Orders increased 135% YOY, and sales increased 35%. AOV was down YOY as basket sizes were smaller in 2020.

- Apparel & accessories: Sunday – Tuesday leading into Cyber Week saw a 30% YOY increase in total orders. Black Friday & Cyber Monday were the top converting days with a conversion rate of over 6.7%.

- Electronics & software: Overall, total orders increased 59% compared to 2019, Sunday – Wednesday before Thanksgiving. Notable order increases were seen on days leading into Thanksgiving and on the Sunday before Cyber Monday with a 112% YOY growth.

- Beauty Stores: The total orders for Black Friday increased by 17% year-over-year, and conversion rates peaked at 9% on Cyber Monday. The fastest growing shopping days all happened before Thanksgiving with Tuesday being the fastest growing day for orders and sales.

As for the top performing products, shoppers tended to favor a combination of flashier products and products that could be used to improve their home lives.

Canada Cyber Week Trends

Black Friday Dominates the Weekend

Canadian shoppers did more of their shopping on Black Friday. Clicks, orders and sales were all at their highest that day, suggesting that much like their neighbors to the South, Canadian shoppers are conditioned to expect the best deals on major sales holidays.

Gifts that Canadian shoppers were buying may have been a function of the fact that people are continuing to spend more time at home.

Product verticals seeing the greatest growth on our Canadian network during Cyber Week 2020 include:

- Beauty and personal care, up 58% year-over-year

- Housewares and small appliances, up 45% year-over-year

- Sporting goods, up 23% year-over-year

Canadian Shoppers Prefer Buying on Desktop

Orders on desktop devices from Canadian holiday shoppers outnumbered purchases made on mobile devices by a ratio of more than 2:1 on most days during Cyber Week. This suggests that Canadian holiday shoppers still feel more comfortable buying on desktop devices and are showing an inclination to do so while staying at home through the holidays.

Ready to start building on your holiday momentum? Contact us today to learn more about how we can accelerate your performance marketing campaigns.